Binance Grid Bot

Binance’s grid bot allows you to use your futures account to trade in crypto currencies. It is a useful tool for trading in the volatile market. You can place buy and sell orders according to your preference and the system will execute the orders when one is filled. The bot is free to use. However, you will need to deposit USDT to the futures wallet to start using the software.

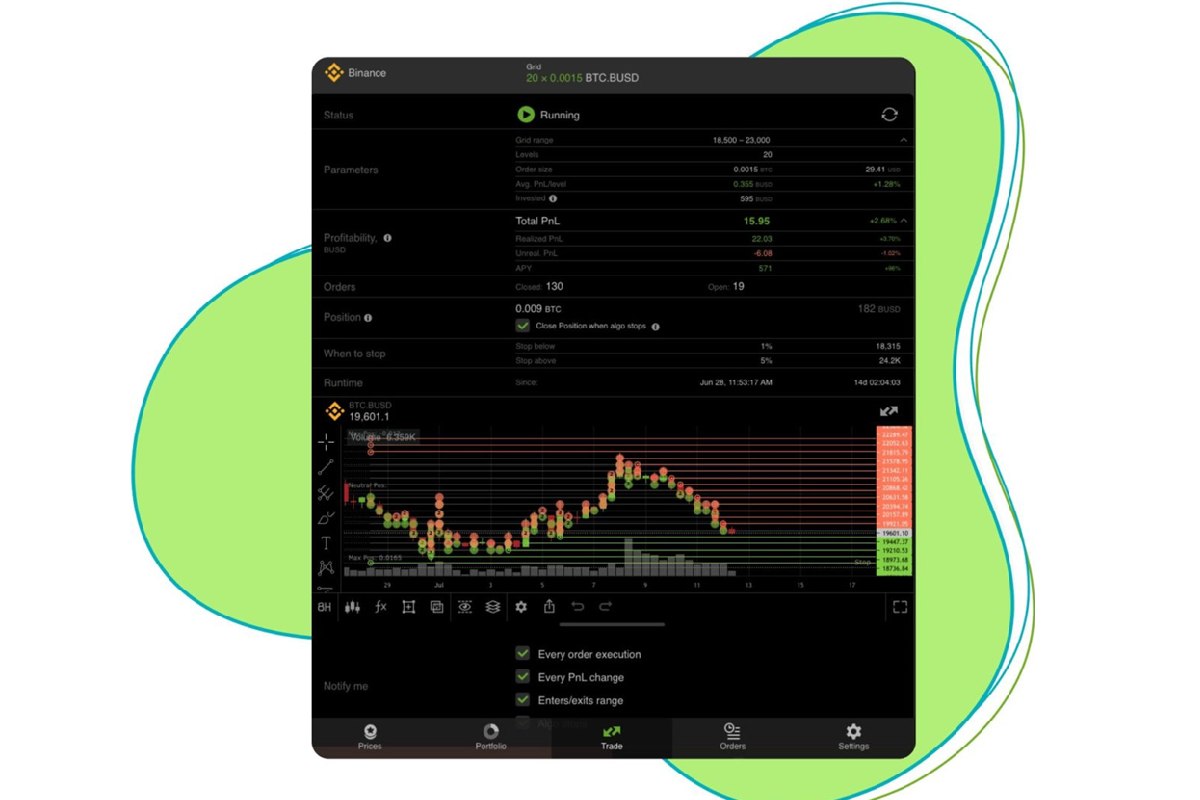

Unlike other types of trading bots, Binance’s grid bot does not require a membership fee. The system can also be customized, allowing you to set the number of grids, their spacing, and their limit. You can also adjust the strategy that the bot follows. It also performs a stop-loss grid that automatically closes open positions when the grid stops. This can help you maximize your profits.

The Binance grid bot is designed to make your investment more profitable. Unlike traditional trading, it does not need constant chart monitoring. It works by setting up a grid of buy and sell orders within a certain price range. As long as the prices do not exceed the limit that you have set, your bot will place a purchase or sell order at the lower or higher level. The bot will repeat the process until it achieves its profit target. It is very effective in uptrending and downtrending markets.

The most popular exchanges for grid trading include Binance, KuCoin, and Kraken. If you do not have an account with any of these platforms, you can create one by typing “Futures” in your account’s header. The commission fee is converted into margin assets at the time of transaction.

With a bit of practice, you can develop a good grid trading strategy. However, this is a time-consuming method. A better option is to get a dedicated grid bot. The software will help you in developing a profitable trading strategy that is tailored to your style and your market conditions. The most popular crypto grid trading bots are available on all major exchanges.

In order to maximize your gains, it is recommended to choose a trading bot that provides you with a variety of presets. Some of these options include the Short Grid, the Neutral Grid, and the Long Grid. The Long Grid is ideal for a trending market, while the Short Grid is useful in a bearish market.

Another good option for those looking to increase their profits is the Futures Grid. The grid will allow you to define the number of grids, the type of grid spacing, and the price range. This will then be used as the basis of your trading strategies. You can also set up limit orders, which are automatically triggered when the market price falls below the trigger price. You can also place your orders immediately, while the system will update the grid as soon as the limit order is filled.

With a grid bot, you can profit from any market condition. Whether you are looking to take advantage of a commodity trend, or want to capitalize on volatility, a bot can help you succeed.